Payoneer.com Review 2020

In this post you will get all the information on how to send and receive money on Payoneer 2020 Payoneer has established itself as an online money transfer service provider for businesses and freelancers. Businesses making payments to contractors and vendors, receiving payments from customers or looking to convert currencies, Payoneer is one of the go-to solutions. Freelancers can receive payments directly into their Payoneer accounts from online marketplaces and networks such as Airbnb, Upwork, Cdiscount, Fiverr, CJ Affiliate, Wish, Getty Images, HomeAway, Rakuten, Lazada, and Tradedoubler AB. With Payoneer, you are ensured of low transfer fees, payments in minutes, and the flexibility of accessing cash either at ATMs or nearby bank accounts. Read more on How to Send and Receive Money on Payoneer Online.

How to Register on Payoneer to Send and Receive Payment from Abroad

Payoneer is a quick and easy solution to receiving payments worldwide. It's another and an alternative method for getting paid for performing services or freelance work. Payoneer also gives you an alternative method to pay individuals directly without ever going through a third-party payment service just to get the payment sent from across the globe.

Payoneer users will get an ATM Debit card that has the Mastercard logo and they can withdraw the funds at any ATM machine that accepts Mastercard. Learn more about How to Send and Receive Money on Payoneer from Abroad.

How to register on Payoneer and Get Chance to Earn $25 On Signup

- Go to https://www.payoneer.com/ to begin the signup process.

- Fill out the required details and connect a government-issued ID such as a Passport, Driver's license or a National ID.

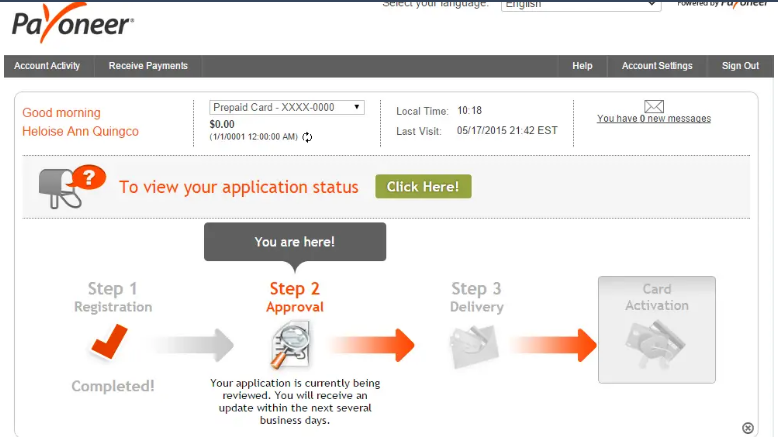

- As soon as the application is approved, you'll receive confirmation that your card will be delivered. The entire application process, from signing up online to

- receiving the card, for the most part just takes a couple of business days.

- When you've received the card, activate it and start receiving payment from anyplace around the globe!

Internationally, Payoneer serves 200+ countries in more than 150 currencies. The minimum you can withdraw is $20 and the fee charged per withdrawal is $3. This means when withdrawing amounts as enormous as $1,000, the $3 will be insignificant.

Internationally, Payoneer serves 200+ countries in more than 150 currencies. The minimum you can withdraw is $20 and the fee charged per withdrawal is $3. This means when withdrawing amounts as enormous as $1,000, the $3 will be insignificant.Payoneer Credibility and Security

Would I be able to trust Payoneer? Yes. Payoneer is an enormous, legitimate and trustworthy business. Payoneer was founded in 2005 and is upheld by the same investors who subsidized Facebook, Dropbox, and Expedia. Since they were founded, they have grown to more than 1,000 employees all-inclusive, situated across 14 offices around the globe.

Thousands of companies, marketplaces, and individuals use Payoneer's services to make and receive payments and send funds worldwide. Payoneer has full international regulatory status in multiple regions, including the US (United States), EU, Hong Kong, India, and Japan. Here is a statement from their website:

"Our center obligation at Payoneer is to ensure your funds and forestall money laundering. As a managed entity, we provide multi-jurisdictional compliance assurances to your business. While partnering with us, you can be assured that all your payee disbursements are made through a completely compliant, secure and tightly audited payments stage that is recognized by financial regulators all around the globe." Learn more about How to Send and Receive Money on Payoneer Worldwide.

Payoneer have received numerous awards, some of the later include:

- Payoneer is perhaps the best work environment in NYC

- Payoneer Listed for Sixth Year in a Row on Deloitte's 2017 Technology Fast 500

- Payoneer Makes Inc. 5000 Fastest-Growing Private Companies List for the Fifth Year in a Row

- Payoneer is one of Inc. Magazine's Best Workplaces 2017

- Payoneer is also completely PCI DSS compliant, meaning they provide robust payment card security.

Pros of Payoneer Account

- Wide presence in 200 countries

- Custom invoices and lets you request payment from individual clients

- Customer support

- Free payments between Payoneer accounts

Cons of Payoneer Account

- There are several different types of fees

- High card transaction fees

How do I add Funds/Money to my Payoneer Account?

The easiest method of receiving money on your Payoneer account is through a transfer from another Payoneer account.

- You should simply ask another Payoneer user to do the following:

- Go to the official Payoneer Website

- Sign in using the Payoneer account

- Connect your bank account with it

- Select Make a Payment

- Select the Currency and the sum that needs to be sent

- Keep note that a minimum sum needs to be present on the account as of now in request to make a payment

- Enter their credentials cautiously Start with the transfer

- Funds will be transferred as right on time as within 2 hours and there is no cost when paying from Payoneer to Payoneer

You can also stack your card either by either:

- Working for one of the marketplaces

- From a US/EU payment services

- All things being equal, you must recall that most of the time you have to send a Payment Request in advance

- The absence of diversity in terms of how you can add money to your Payoneer account is truly logical.

This is because the main purpose of services like Payoneer is that of facilitating the payments from enormous institutions and companies towards employees.

As such, whatever another method that would result in you getting money on your Payoneer account could be considered a workaround, best case scenario. Read more on how to send and receive Money on the Payoneer account from Amazon and other networks.

How do I activate my Payoneer Prepaid Card? - Simple Steps

- Go to the official Payoneer Website

- Sign in to your Payoneer account

- Select Settings

- Go to Card Management

- Find the card you have to activate and click ACTIVATE

- Click the Card Activation button

- Enter the 16-digit card number

- Choose a 4-digit PIN for your card

- You'll need to recollect this PIN since you'll use it each time you need to withdraw money from an ATM machine

- All the more so, you'll also require it at whatever point making purchases

- Make sure your PIN is easy to recollect

- Never share your PIN with any other individual

- Confirm your PIN

- Press ACTIVATE

A confirmation message will show up When the sum total of what steps have been finished, make sure you Sign Out from your Payoneer account

Don't activate your Payoneer card on a public PC, as it might put your personal info as well as your funds at serious risk.

How do I withdraw money/funds from my Payoneer Prepaid Card?

- Go to the official Payoneer Website

- Sign in to your Payoneer account

- Go to Withdraw

- Select To Bank Account.

- Select the currency balance or the card you need to withdraw funds from

- Enter the specific withdrawal details:

- Choose the bank account you need to withdraw to

- If you need to make another account, go to the Bank Management tab or adhere to the structure of the instruction the Bank Accounts Tutorial

- Write down the measure of money you need to withdraw, all while keeping a note of your present balance in that currency

- You could also enter a description for your records, yet this is simply optional

- Click Review

- This will give you a final overview of the withdrawal you are going to make

- Peruse every one of the details you have written cautiously

- If you see any mistake, simply press the Edit button to transform it

- When you are 100% sure the details you entered are right, press Withdraw

How to register Payoneer Account for Companies

If you have more than 5 workers that you send money to you can register for an organization account here. This will give you access to an account where you can support the account with one ACH and afterward easily send multiple transfers to your workers.

If you have less than 5 workers then you can endeavor to stack funds physically onto a Payoneer card (See the section beneath on "Loading a Payoneer card physically").

However, this method will work for sending money to a Payoneer card and will not work for sending money via nearby bank transfer to the recipient.

How much does it cost to use Payoneer in 2020?

Opening an account with Payoneer is free, and making payments through Payoneer's Make a Payment service is free. Getting paid directly from your customers does incur a fee: 3% for credit card payments and 1% for eChecks. Withdrawing funds from your Payoneer account also comes with a fee. Withdrawing money from your Payoneer account to a bank account in a different currency will cost you up to 2% of the sum you're withdrawing. If you're moving money into your bank account in the same currency you'll pay $1.50 for the transaction.

What types of services does Payoneer offer to customers?

Receive payments. Send a payment request and get paid in your Payoneer account. You can withdraw your funds at an ATM or transfer them directly to your bank account, which comes with a fee.

- Make payments. Send and receive payments between Payoneer accounts free of charge.

- Send mass payments. Make mass payments to your freelancers.

- Automated payments. Set up automated payments.

- Escrow payments. Make secure B2B transactions with Payoneer's escrow payments.

How much does Payoneer cost for send and receive money?

Opening a Payoneer account is free, and Payoneer offers different ways to send and receive money on Payoneer from abroad.

- Receiving money

- Make a Payment

- Make a Payment, making and receiving payments as a Payoneer customer is free.

Payoneer Provide Worldwide Payment Service

If you're selected the Global Payment Service, Payoneer will give you receiving accounts for U.S. dollars (USD), euros (EUR), British pounds (GBP) and Japanese yens (JPY). This way, you can receive different currencies.

- For EUR, GBP, and JPY: Free to receive money

- For USD: 1% fee

Receive payments from customers on Payoneer

At the point when you use the Billing Service to receive payments, you'll pay different fees for payment with the credit card or eCheck.

Via credit card (all currencies): 3% fee

Via eCheck (USD): 1% fee

Marketplaces and networks

Marketplaces like Fiverr, Upwork and Airbnb set their own fees for withdrawing payments. Find rates on the stage you work with.

Withdrawing money

- You'll pay a different fee depending on whether you're withdrawing the funds in the same currency or a different currency.

- Withdrawing money from your Payoneer account to a bank account in a different currency will cost you up to 2% over the mid-advertise rate.

- If you're moving money into your bank account in the same currency you'll pay $1.50 for the transaction.

- If you are a high worker, you may have lower fees.

What types of services does Payoneer offer?

Payoneer offers three different payment services.

- Mass Payout Services. Payoneer helps marketplaces like Upwork and Airbnb send payments to freelancers and contractors.

- Billing Service. If you're a business proprietor or a freelancer, you can request payment from your clients.

- Make a Payment. Send money to some other Payoneer account. You have to actively receive payments before you can access Make a Payment.

At the point when you pay someone through Payoneer, the funds go into their online Payoneer account. From that point forward, the payee has options for withdrawal:

- A prepaid Mastercard from Payoneer

- Local bank transfer in excess of 200 countries. Payoneer calls this the Global Payment Service.

- Payoneer's Make a Payment to send currency to other Payoneer accounts. For instance, a chief can receive payment for a vocation, at that point pay employees from the same account.

What types of transfers does Payoneer support?

All transfers go through the Payoneer stage. You can send payments by:

- Credit card

- eCheck

- Local bank transfers

Your payee will receive your payment in their Payoneer account. The transfer should take close to two hours. Recipients can withdraw funds by:

- Prepaid Mastercard from Payoneer

- Local bank transfer

- Payoneer doesn't offer physical branches. All transactions are processed online.

- Payoneer trade rates

While using Payoneer, you might be paid in one currency and withdraw the funds in another currency. In that case, you'll pay a currency conversion fee of up to 2% above the mid-showcase rate. In some countries, that fee might be 2.75%.

Payment options on Payoneer

- Transfer Options: Online, Telephone

- Withdrawal Options: Bank

- Payment Options: Bank Transfer, Credit Card, Debit Card

- Customary Payments: No

Get Support from Payoneer Using These Links

Support Options:

- Live Chat, Telephone

- Facebook Profile: https://www.facebook.com/Payoneer/

- Twitter Profile: https://twitter.com/Payoneer

- LinkedIn Profile: https://www.linkedin.com/company/payoneer/

You May Also Like These Articles:

Comments

Post a Comment